อ่านรายละเอียดเพิ่มเติม

05.09.2022 11:34 PM

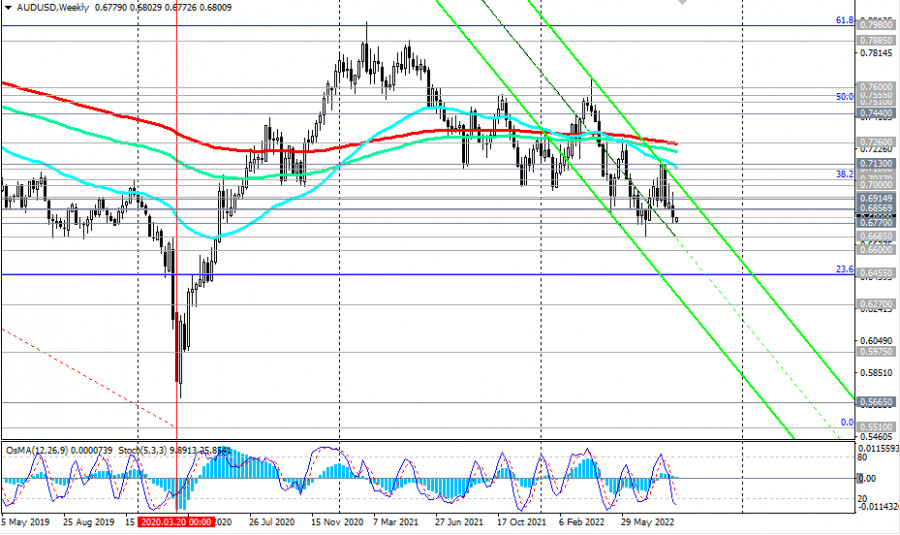

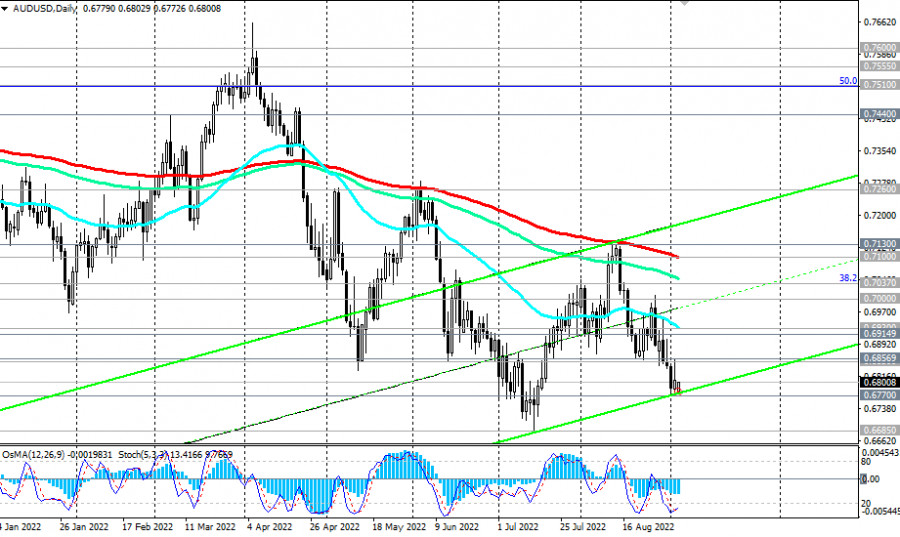

05.09.2022 11:34 PMAs we took note of in our Fundamental Analysis, at the time when this article was made, AUD/USD was trading near 0.6800, remaining in the bear market zone below key resistance levels 0.7100 (EMA200 on the daily chart), 0.7260 (EMA200 on the weekly chart) and had a tendency to decline further.

Most likely, a breakdown of the local support level of 0.6770 will lead to the continuation of the downward trend in AUD/USD. In this case, the pair will continue to decline inside the descending channel on the weekly chart. Its lower limit is below 0.6100. This mark will probably become the target of further decline.

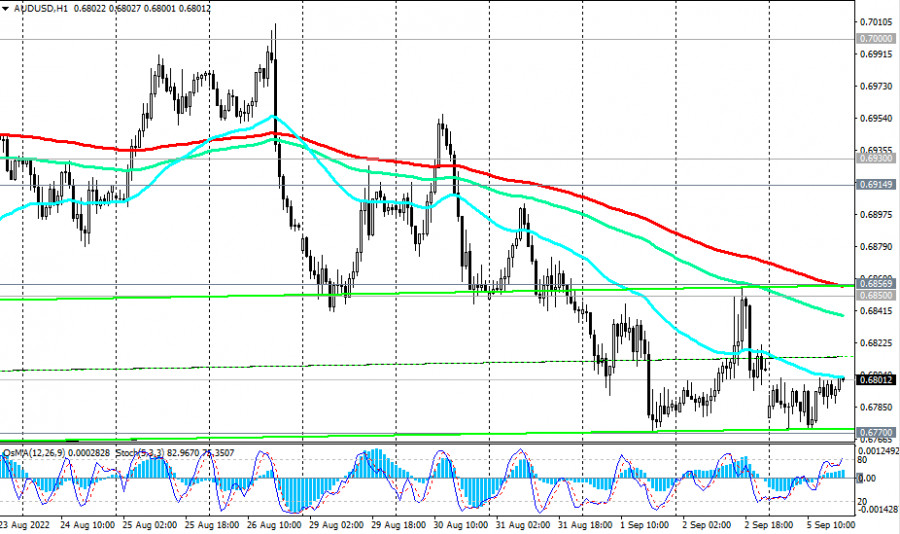

In an alternative scenario, and after the breakdown of the resistance level of 0.6856, AUD/USD will head (as part of an upward correction) towards the resistance levels of 0.6920 (EMA200 on the 4-hour chart), 0.6930 (EMA50 on the daily chart).

It is still too early to talk about stronger growth. In the main scenario, we expect AUD/USD to decline.

Support levels: 0.6770, 0.6700, 0.6685, 0.6660, 0.6500, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Resistance levels: 0.6850, 0.6856, 0.6900, 0.6915, 0.6930, 0.7000, 0.7037, 0.7100, 0.7130, 0.7200, 0.7260

Trading Recommendations

Sell Stop 0.6760. Stop Loss 0.6860. Take-Profit 0.6700, 0.6685, 0.6660, 0.6500, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Buy Stop 0.6860. Stop Loss 0.6760. Take-Profit 0.6900, 0.6915, 0.6930, 0.7000, 0.7037, 0.7100, 0.7130, 0.7200, 0.7260

You have already liked this post today

*บทวิเคราะห์ในตลาดที่มีการโพสต์ตรงนี้ เพียงเพื่อทำให้คุณทราบถึงข้อมูล ไม่ได้เป็นการเจาะจงถึงขั้นตอนให้คุณทำการซื้อขายตาม