Veja também

18.12.2025 12:28 AM

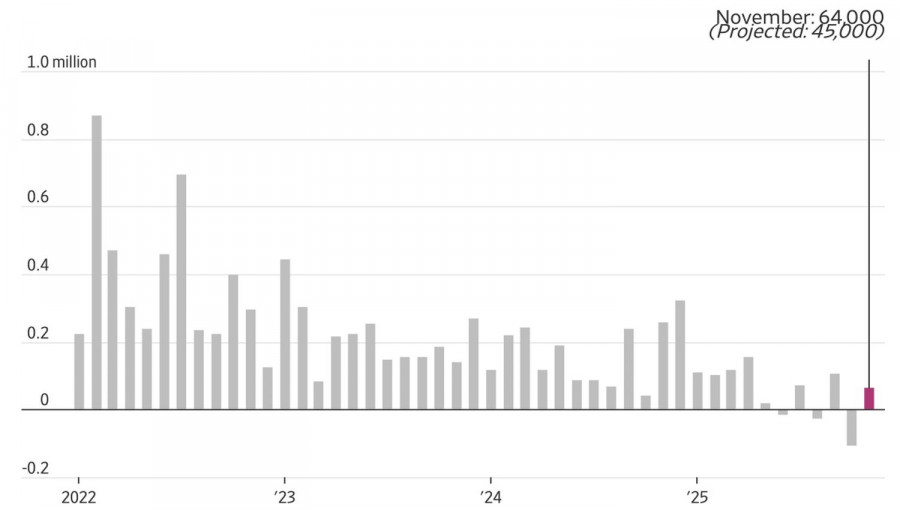

18.12.2025 12:28 AMThe market bought the rumor and sold the fact, while the worsening outlook for the German economy acted as a catalyst for the EUR/USD pullback. Moreover, the situation in Ukraine remains unresolved. U.S. employment figures are disappointing, with the unemployment rate rising to 4.6%. Overall, the BLS report gives the Federal Reserve a reason to sit back and observe how events unfold. This allowed traders to take profits on their long positions in the euro.

The U.S. labor market continues to cool, with consumers refraining from excessive spending, as evidenced by retail sales data. American purchasing managers' indices also leave much to be desired. There is a visible deterioration in the U.S. economy. The narrowing gap between the U.S. economy and its European counterpart played in favor of the EUR/USD bulls—if only all were calm in the EU.

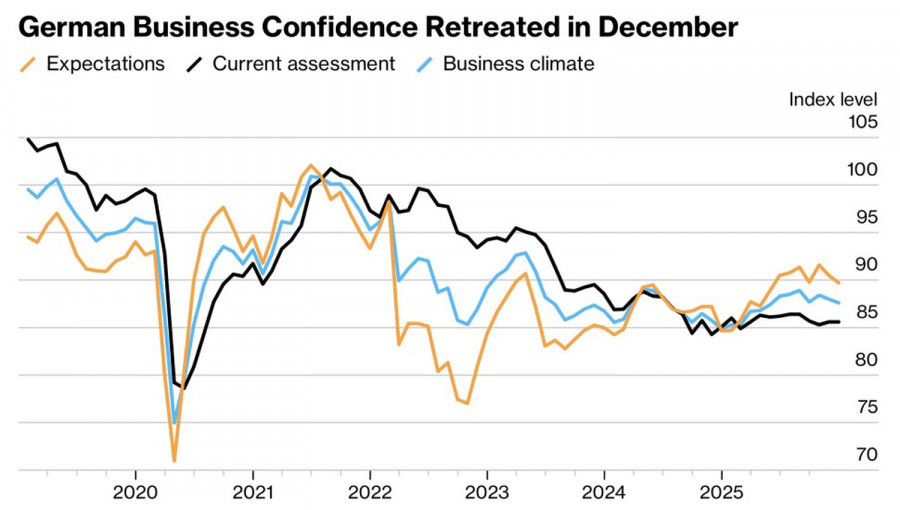

Unfortunately, the decline in business confidence in Germany indicates that the peace of the euro is a mere fantasy. The IFO index expectations fell from 90.5 to 89.7, while the current conditions measure remained unchanged. Companies in Germany are more pessimistic about the first half of 2026. The coming year will start for the eurozone's leading economy without much optimism.

The European Central Bank will surely take this fact into account at its December meeting. However, unlike other central banks, it has something to boast about. Inflation is considered securely anchored near 2%, and the economy has adapted to U.S. tariffs. Investors assess the cycle of monetary expansion as complete, with no changes to the deposit rate expected until 2027. The odds of an increase from the current 2% level are higher than the likelihood of a decrease.

At the same time, the EUR/USD response to U.S. employment data has allowed the ECB to relax. The euro did not strengthen, meaning there will be no slowdown in inflation in the eurozone. Christine Lagarde can set aside the idea of verbal interventions and focus on monetary policy.

While all remains stable in Europe, the future of EUR/USD depends on events occurring in the United States. After the labor market data, investor attention has shifted to U.S. inflation data. An acceleration in inflation would become a serious trump card for the FOMC "hawks" and would allow the U.S. dollar to continue its advance against major world currencies, with the euro being no exception.

Goldman Sachs expects consumer prices in the United States to slow down from 3% to 2.9%. Inflation is still too high for the Fed to rest on its laurels like the ECB. The further dynamics of inflation will affect the futures market's chances for a federal funds rate cut.

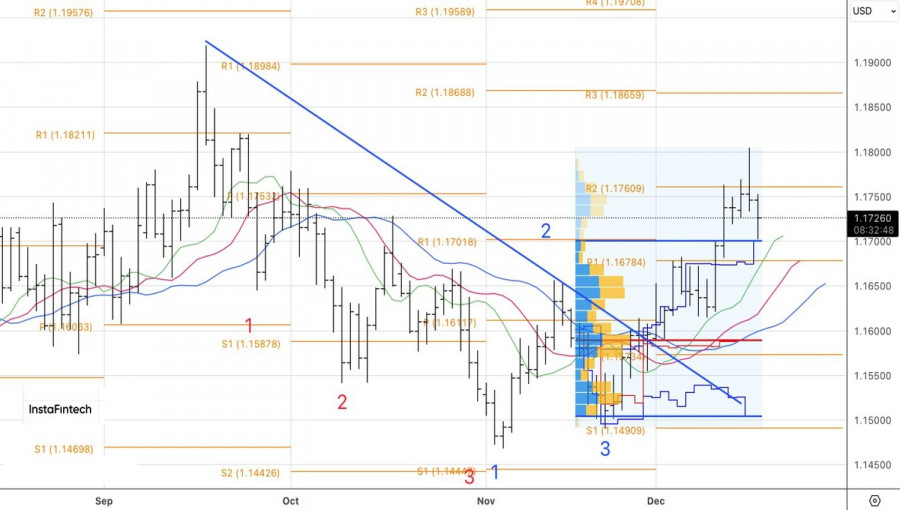

Technically, the daily chart of EUR/USD shows the formation of a pin bar with a long upper shadow, indicating weakness among the bulls. As long as prices remain below the low of this bar at 1.1735, it makes sense to consider short-term selling.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.